Why Choose Us?

Expertise in Lofts and Residential Investments

As the premier consulting firm in Denver specializing in lofts and residential investments, we have a deep understanding of both the financial and property aspects of real estate. With our comprehensive resources and community support, Denver Lofts is the go-to resource for all your real estate needs.

Discover the Latest Trends in Denver’s Real Estate Market

Stay informed with our up-to-date news and analysis on Denver’s ever-changing real estate landscape.

Expert Insights and Analysis for Informed Decisions

Join our community and gain access to valuable information for maximizing your investments in Denver’s property market. Trust Denver Lofts as your go-to resource for all things finance and property.

Welcome to Denver Lofts

Your Go-To Source for Real Estate Information

With our expertise in finance and property, Denver Lofts offers invaluable insights and advice for navigating the dynamic real estate landscape.

Our Comprehensive Services

At Denver Lofts, our team of expert consultants is dedicated to helping you achieve your real estate goals.

Professional Investment Analysis

With our knowledge and expertise, we analyze and evaluate real estate investments to help you make informed decisions.

Expert Market Research

Stay ahead of the curve with our in-depth market research.

Discover the Latest Trends in Denver Real Estate

Residential Investments

2.5M

Loft Properties Available

100

Profitable Investment Opportunities

$4.3M

Our Impressive Portfolio

Discover our impressive portfolio of successful residential investments and consulting projects in Denver.

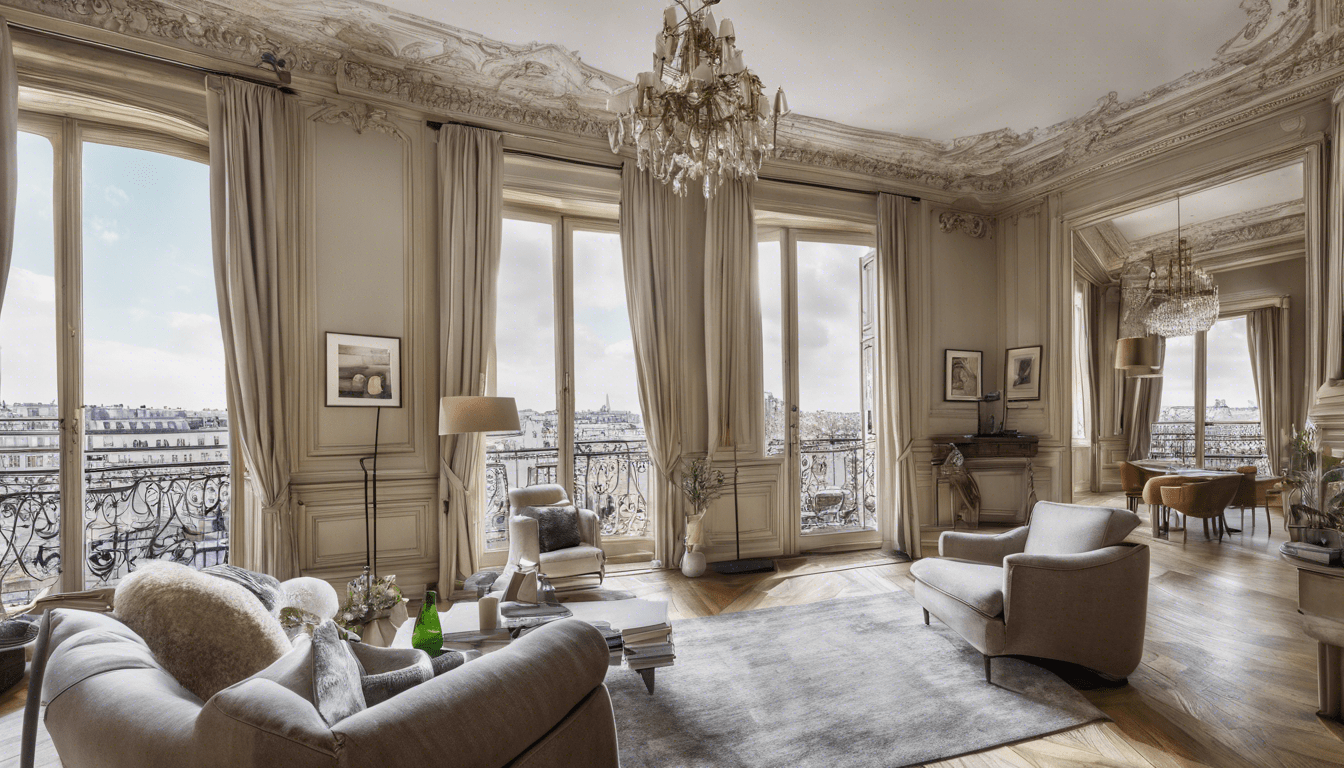

Luxury Residential Investment

Profitable Consulting Project

Transforming a Historic Property

Maximizing Returns on Townhome Development

Revitalizing Downtown Lofts

Successful Office Building Investment

Latest news

Unlocking the secrets to effective credit management

Effective credit management separates thriving businesses from those struggling with cash flow and bad debts.[…]

Uncover exceptional ski apartments for sale in méribel

Méribel offers an exceptional chance for discerning buyers seeking ski apartments nestled in the heart[…]

Simplify your rental guarantee experience in Belgium today

Navigating the rental guarantee landscape in Belgium can feel overwhelming. However, understanding your options can[…]

Discover the Paris real estate journey: find your ideal home

Embarking on the journey to find your ideal home in Paris can be both thrilling[…]

Unlock your dream home: the paris real estate experience

Finding your dream home in Paris is more than just a transaction; it’s a journey[…]

Experience stress-free home buying with a real estate agency in spain

Buying property in Spain doesn’t have to be overwhelming. With the right real estate agency,[…]

What Are the Emerging Trends in Bristol’s Real Estate Market for Young Professionals?

Bristol, a city that has long been considered one of the most liveable locations in[…]

Can UK Landlords Deduct Property Insurance From Their Taxes?

Understanding how to navigate the complex terrain of taxes can be challenging, especially when you[…]

Boosting Rental Profits: A Guide for London Zone 1 Property Owners on Thriving with Short-Term Leases

Understanding Short-Term Rental Opportunities in London Zone 1 In the vibrant sphere of short-term rentals,[…]

How to Ensure Your UK Property is Compliant with Fire Safety Regulations?

Fire safety is a paramount concern for property owners, landlords, and tenants alike. In the[…]

Mastering the UK”s Stamp Duty Surcharge: A Comprehensive Guide for International Buyers

Understanding the UK’s Stamp Duty Surcharge The Stamp Duty Surcharge is an additional tax imposed[…]

How Does Subsidence Affect Your Home Insurance Premiums in the UK?

Subsidence, the process where the ground beneath a property moves or ‘sinks’, is a matter[…]

Maximizing Impact: Strategies for Developers to Enhance Mixed-Use Projects in Sheffield”s Urban Renewal Areas

Sheffield's urban renewal areas present a unique opportunity for developers to create vibrant mixed-use projects[…]

Can the Adoption of Modular Construction Solve the UK’s Housing Crisis?

Across the globe, cities are grappling with housing crises and the UK is no exception.[…]

How Does Age Affect Life Insurance Policies for Mortgage Protection in the UK?

As a responsible family member, you may well have considered the necessity of a life[…]

How can non-residents secure a mortgage for UK property investment?

Acquiring a property in the United Kingdom is an attractive venture for non-residents, thanks to[…]

How to assess the flood risk before purchasing a UK property?

When considering a property purchase in the UK, the potential risk of flooding is an[…]

What steps should be taken to improve one’s credit score before applying for a UK mortgage?

A credit score is like a financial report card, reflecting your reliability as a borrower.[…]

How to find the most competitive bridging loan rates for a property transaction in the UK?

A bridging loan is a short-term financing option that people often use to cover gaps[…]

What steps should you take to financially prepare for a buy-to-let mortgage application in the UK?

The decision to invest in property is undoubtedly one of the most significant financial steps[…]